Bitcoin, AI, and the Return of Risk

If you scan the market today, it looks chaotic.

Bitcoin trades like a risk asset.

AI stocks feel euphoric.

Crypto equities whip around on headlines, ETFs, and regulatory noise.

But underneath the volatility, something quieter is happening.

Liquidity is easing.

The Fed has started cutting. Real yields are drifting lower. The dollar is softening. Risk appetite is creeping back in; not explosively, but structurally. This is what early liquidity expansion looks like: uneven, selective, and easy to misread.

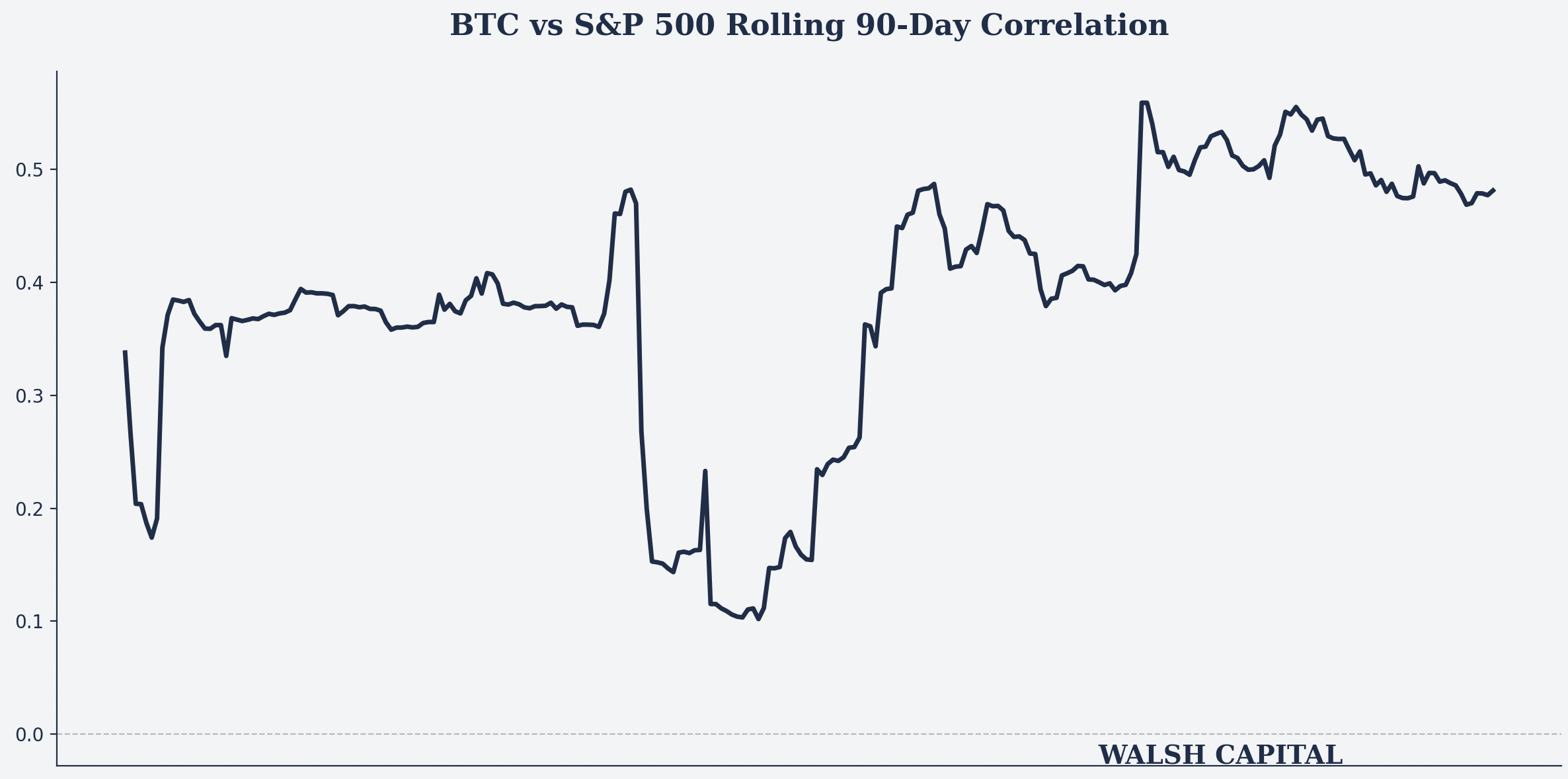

Bitcoin’s behavior tells the story. Its correlation to equities has climbed back toward 0.5. That’s not digital gold. That’s Bitcoin acting like a macro transmission mechanism, amplifying liquidity when it flows, punishing leverage when it retreats.

Over the past year, Bitcoins correlation to equities has climbed back toward 0.5

That dynamic explains why crypto equities are moving the way they are.

Coinbase isn’t just a trading venue anymore. It’s quietly assembling the financial plumbing for a tokenized, permissionless market stack (spot, derivatives, prediction markets, stablecoins). When volatility and liquidity return together, Coinbase’s operating leverage is extreme. That’s not hype. It’s math.

MicroStrategy sits at the other end of the spectrum. It’s not a company so much as a financial instrument. It’s a leveraged, dilution-prone wrapper around Bitcoin itself. When Bitcoin rises, it explodes. When conditions tighten, it breaks faster than the asset it tracks. Optionality cuts both ways.

CleanSpark is more subtle. It looks like a miner, but it’s evolving into something closer to an energy and compute platform. Bitcoin justifies the power contracts. AI may monetize them. If that transition works, the payoff is nonlinear. If it doesn’t, it’s still a high-beta miner in a volatile regime.

Then there’s Nvidia.

Nvidia is what happens when a secular demand shock meets perfect positioning. AI capex isn’t slowing; rather, it’s compounding. Data centers are being built faster than power can be provisioned. Nvidia isn’t just selling chips; it’s selling time. That’s why margins expand even at scale. This isn’t a bubble dynamic yet. It’s an infrastructure build-out.

Robinhood tells you something else entirely.

Retail is back.

Not euphoric. Not reckless. But active. Options, crypto, event contracts, and participation is broadening again. That doesn’t last forever, but it tends to persist longer than people expect once momentum returns.

The common thread across all of this isn’t narratives. It’s positioning under a changing liquidity regime.

Early easing doesn’t reward everything equally. It rewards convexity. It rewards operating leverage. It punishes hidden fragility.

Cash, in this environment, isn’t dead weight. It’s optionality. It’s dry powder for volatility spikes, regulatory surprises, or temporary dislocations in assets that benefit structurally from liquidity but overshoot tactically.

Markets feel noisy right now because they’re recalibrating.

Not to a new story.

To a new risk regime.