Liquidity Is Doing Something Different

If you scan the market today, it looks chaotic. Bitcoin trades like a risk asset, AI stocks feel euphoric, and crypto equities whip around on headlines and regulatory echoes. But underneath the volatility, something quieter, and more structural, is happening.

Liquidity is changing shape.

As the Fed continues its easing cycle and real yields drift lower, we are entering a phase of early liquidity expansion that is uneven and selective. In this environment, the fatal mistake is assuming liquidity lifts all boats the same way.

It doesn’t. Today, liquidity is discriminating. It flows cleanly through some assets while distorting others. To survive this regime, we have to separate three ideas that most traders collapse into one:

Sensitivity (LSS): How much does the asset want to move with the macro tide?

Stability (LCS): Does the connection to macro actually hold under pressure?

Efficiency (LER): Does the macro signal survive the internal company noise?

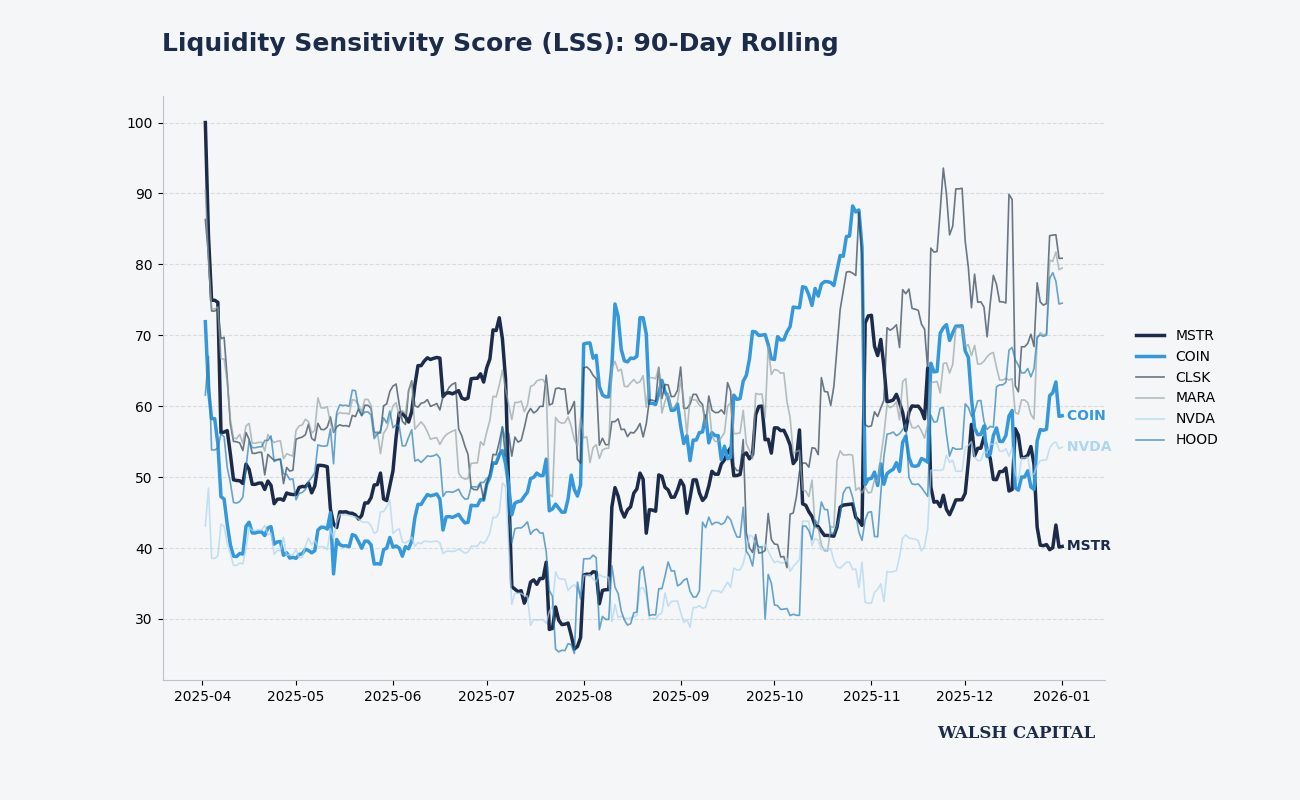

Sensitivity: The Hierarchy Is Breaking

The Liquidity Sensitivity Score (LSS) measures how intensely an asset reacts to a weighted basket of Bitcoin, the Nasdaq, the Dollar, and Real Rates. For years, the hierarchy was simple: crypto stocks were just "high-beta Bitcoin."

That era is over.

MSTR's sensitivity has collapsed from 100 to ~40, indicating it's now an idiosyncratic 'alpha' play, not a pure macro proxy.

The De-Linking of MicroStrategy (MSTR)

The most striking data point from 2025 is the collapse of MSTR’s sensitivity. At the start of the cycle, MSTR’s LSS was effectively maxed out—a perfect synthetic of global liquidity. Today, its sensitivity has plunged to ~40.

This isn’t because Bitcoin stopped mattering; it’s because MicroStrategy has internalized its own volatility. Between aggressive equity issuance and index inclusion mechanics, it has become its own gravitational system. It is no longer a macro mirror; it is a corporate finance engine.

Coinbase as the Pure-Play Weathervane

While MSTR de-links, Coinbase (COIN) has re-asserted itself as the system's "Macro Weathervane." With an LSS climbing back into the 60s, COIN’s revenues scale linearly with market activity. When liquidity expands (rising BTC, rising equities, weakening Dollar) volume follows. COIN is now the "purer" play on the transmission belt.

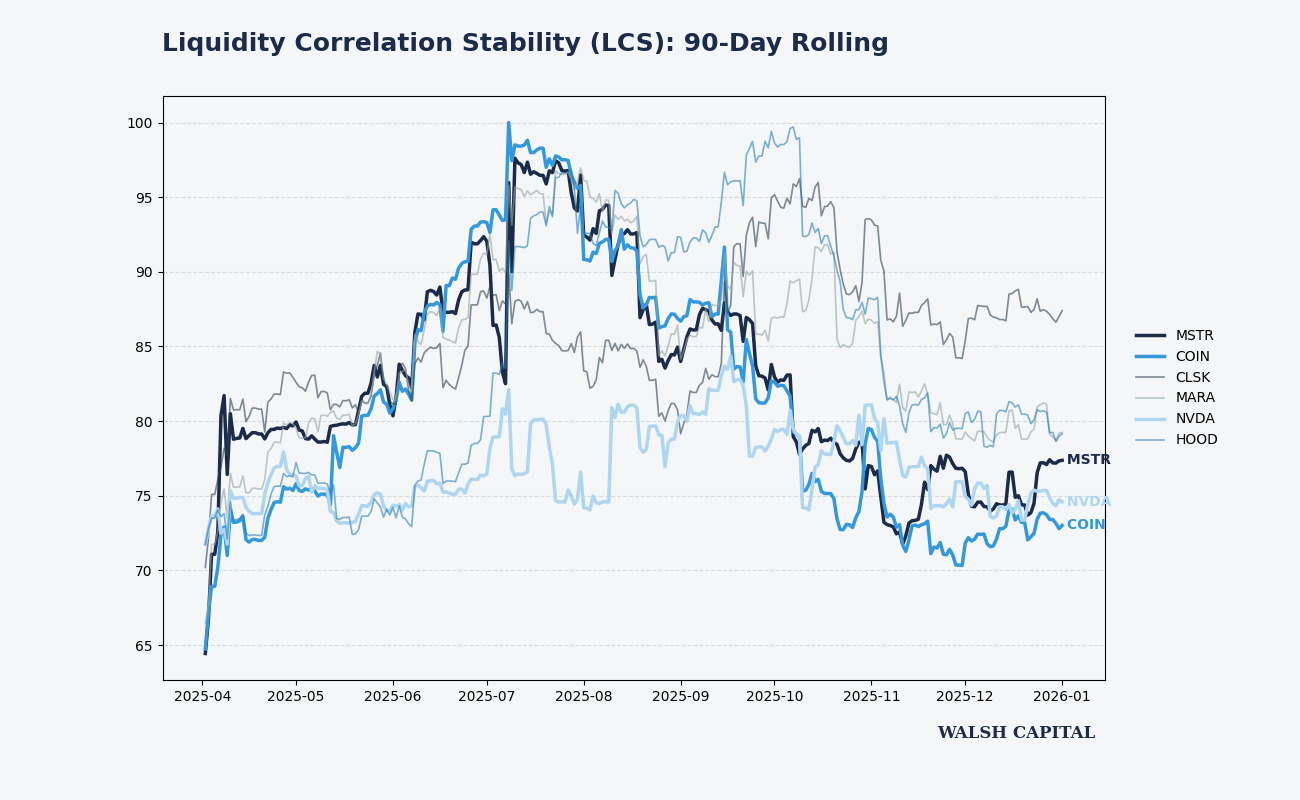

Stability: Beware of "Fragile Beta"

Sensitivity only matters if it’s reliable. Liquidity Correlation Stability (LCS) asks whether the macro drivers are actually staying in sync with the asset.

MSTR's stability has decayed violently, confirming its macro correlations are uncoupling. COIN shows 'fragile beta'.

The Shattered Mirror

In mid-2025, MSTR’s correlation stability was a near-perfect 98. It has since decayed violently. This confirms our "Gravitational Theory": MSTR’s correlations are uncoupling. Sometimes it trades like Bitcoin; sometimes like an equity issuance vehicle. If you are trying to hedge MSTR using a macro basket today, the basis risk will eat you alive.

The Efficiency Trap in COIN

Coinbase presents a different danger. Despite its high sensitivity, its stability (LCS) has cratered. This is Fragile Beta.You can get the macro call perfectly right, the Dollar falls and Bitcoin rips, and still lose money on COIN because regulatory noise or exchange-specific "ticks" interrupt the signal.

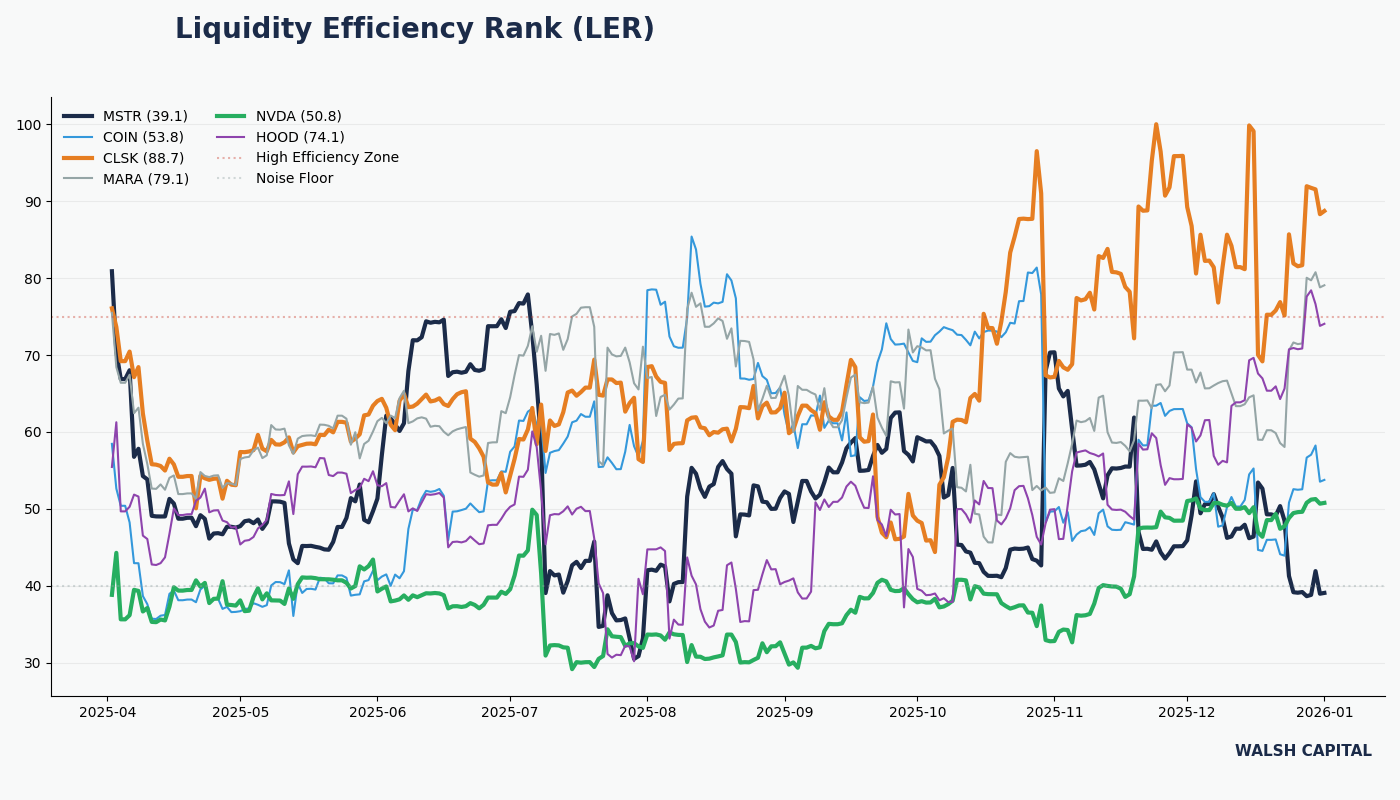

Efficiency: The Only Metric That Matters

The Liquidity Efficiency Rank (LER) is the final filter. It identifies the "cleanest" move per unit of macro risk.

The Structural Anchors (NVDA & HOOD): NVIDIA and Robinhood sit at the top of the LER rankings. They aren't the "wildest" rides, but they are the most efficient. They absorb liquidity the way large institutions need them to: predictably and at scale.

The Quality Gap in Miners: The LER exposes a massive rift between CleanSpark (CLSK) and Marathon (MARA). CLSK is converting liquidity into shareholder value with clinical precision, while MARA is drowning in operational noise. In the mining sector, execution is now a prerequisite for macro expression.

NVDA and HOOD emerge as the most efficient macro proxies, while MSTR's LER has collapsed into the 'noise floor'.

We are no longer in a "Beta Summer" where everything works. This is a Selective Efficiency Regime.

Liquidity doesn't reward conviction anymore; it rewards clean transmission. The "alpha" in 2026 isn't just knowing the Fed will cut; it's knowing which assets are still connected to the wire.

Core Position: NVDA/HOOD for stable liquidity capture.

Tactical Swing: CLSK for "clean" high-beta upside.

The Avoid Zone: Treat MSTR and COIN as idiosyncratic alpha plays, not macro proxies.