Coinbase’s Migration to a Tollbooth

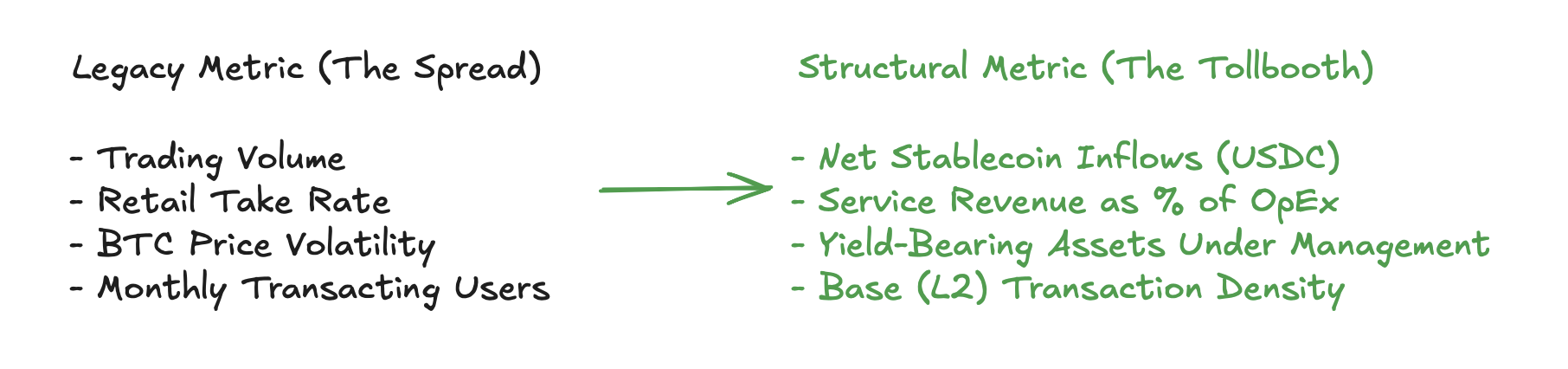

The primary error in Coinbase analysis is the persistent focus on crypto prices and retail trading volumes. While these drive short-term earnings volatility, they are increasingly decoupled from the company’s terminal value.

Coinbase is currently undergoing a structural regime change: migrating from a spread-based exchange to a tollbooth-based financial rail.

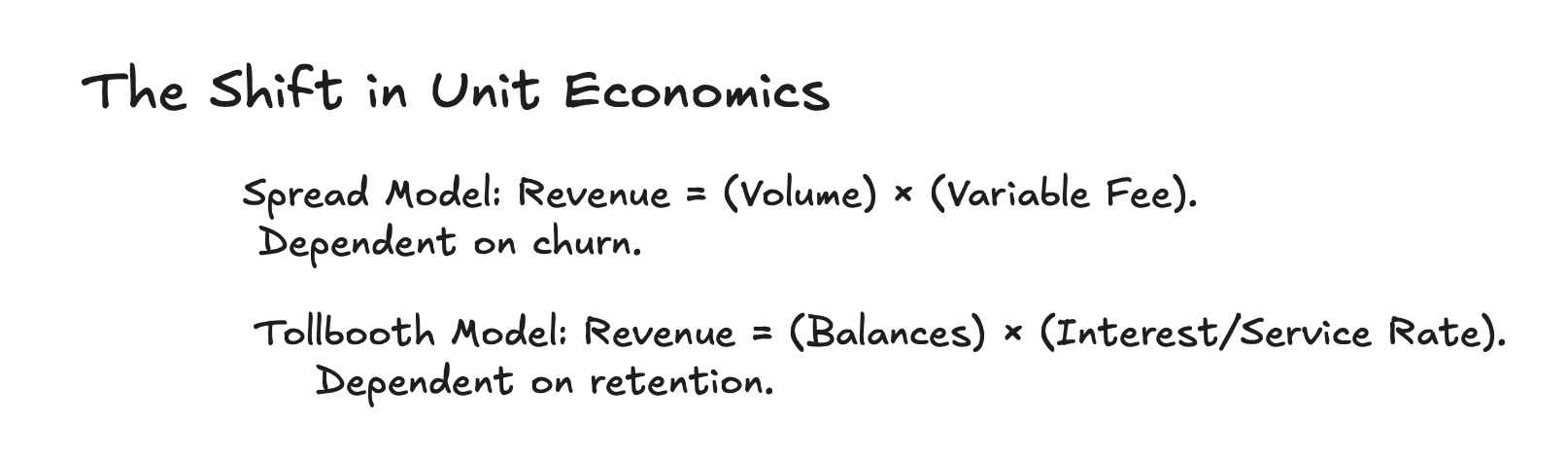

This is the only transition that matters. A spread business is a bet on market friction and retail inefficiency; a tollbooth business is a bet on systemic integration. Coinbase is moving from a model that extracts a fee on the urgency of capital (trading) to one that extracts a yield on the existence of capital (balances and settlement).

The Structural Fragility of the Spread

Transaction revenue, which still accounted for roughly 60% of 2024 revenue, is a fragile unit of analysis. It is constrained by three systemic pressures:

Volatility Decay: Trading revenue is a derivative of volatility, not asset prices. In mid-2025, a period of price stability, even at high levels, resulted in a 40% sequential drop in transaction revenue. When markets "normalize," the spread engine stalls.

Adverse Asset Selection: Approximately 75% of Coinbase’s trading volume originates from assets outside of Bitcoin and Ethereum. These "altcoin" markets possess shallow liquidity that evaporates first during regime changes, making fee revenue more brittle than headline crypto indices suggest.

The Inevitability of Compression: In every mature financial market, spreads trend toward zero. Morningstar’s "no-moat" rating reflects this reality: as regulatory clarity (such as the 2025 Genius Act) invites institutional incumbents, Coinbase’s ability to charge premium retail spreads becomes a liability, not an advantage.

The Tollbooth: Revenue from Persistence

The "Subscription and Services" segment is not a secondary revenue stream; it is the new control plane. This model relies on Assets Under Custody (AUC) rather than Daily Active Users (DAU). It replaces the "high-fee trade" with the "low-fee hold."

The primary driver of this transition is USDC. Within this system, USDC acts as the reserve asset that converts speculative energy into predictable interest income. By late 2025, USDC balances on the platform reached an all-time high of $15 billion. Here, Coinbase functions as a digital shadow bank, capturing the net interest margin on the ecosystem's liquidity.

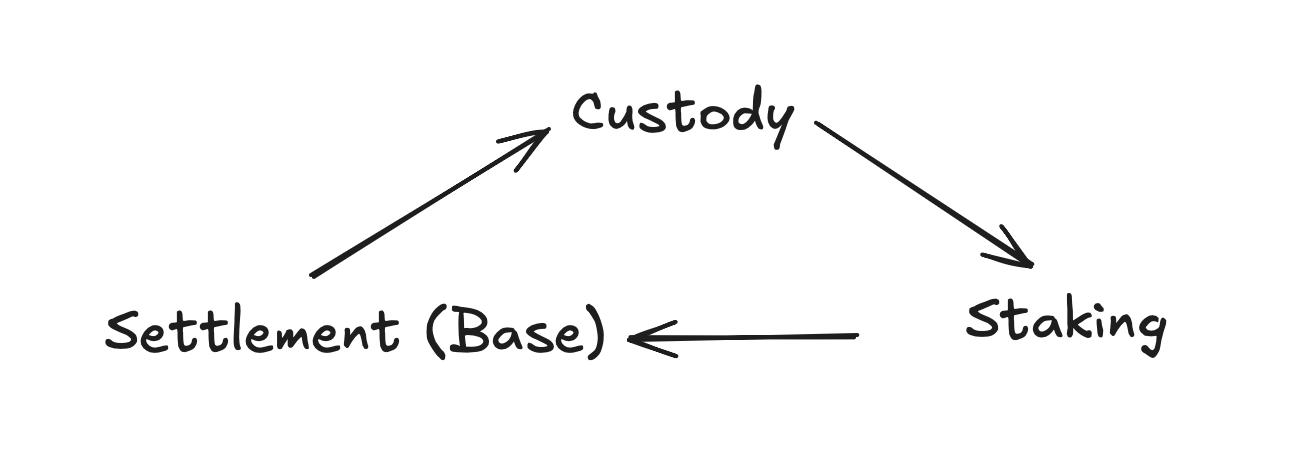

The flywheel is now structural:

Custody: Institutions anchor the system (AUC exceeded $400B in early 2025).

Staking: Idle assets are converted into productive capital, with Coinbase capturing a service fee on the network yield.

Settlement (Base): By migrating transactions to its Layer 2 (Base), Coinbase captures the settlement layer, earning fees on the literal tracks of the on-chain economy.

Trust as the Binding Constraint

In a tollbooth model, the binding factor is no longer product features; it is systemic trust.

While the May 2025 security breach resulted in an estimated $180–$400 million in remediation, the financial cost was secondary to the structural risk. In a transaction model, a breach is a PR crisis; in a tollbooth model, it is a threat to the "vault" architecture. If the vault is perceived as penetrable, the migration of capital stops. Trust is the only variable that allows Coinbase to maintain pricing power as spreads elsewhere compress toward zero.

The New Analytical Frame

To evaluate Coinbase in its current regime, investors must discard legacy metrics in favor of structural indicators:

Positioning and Terminal Value

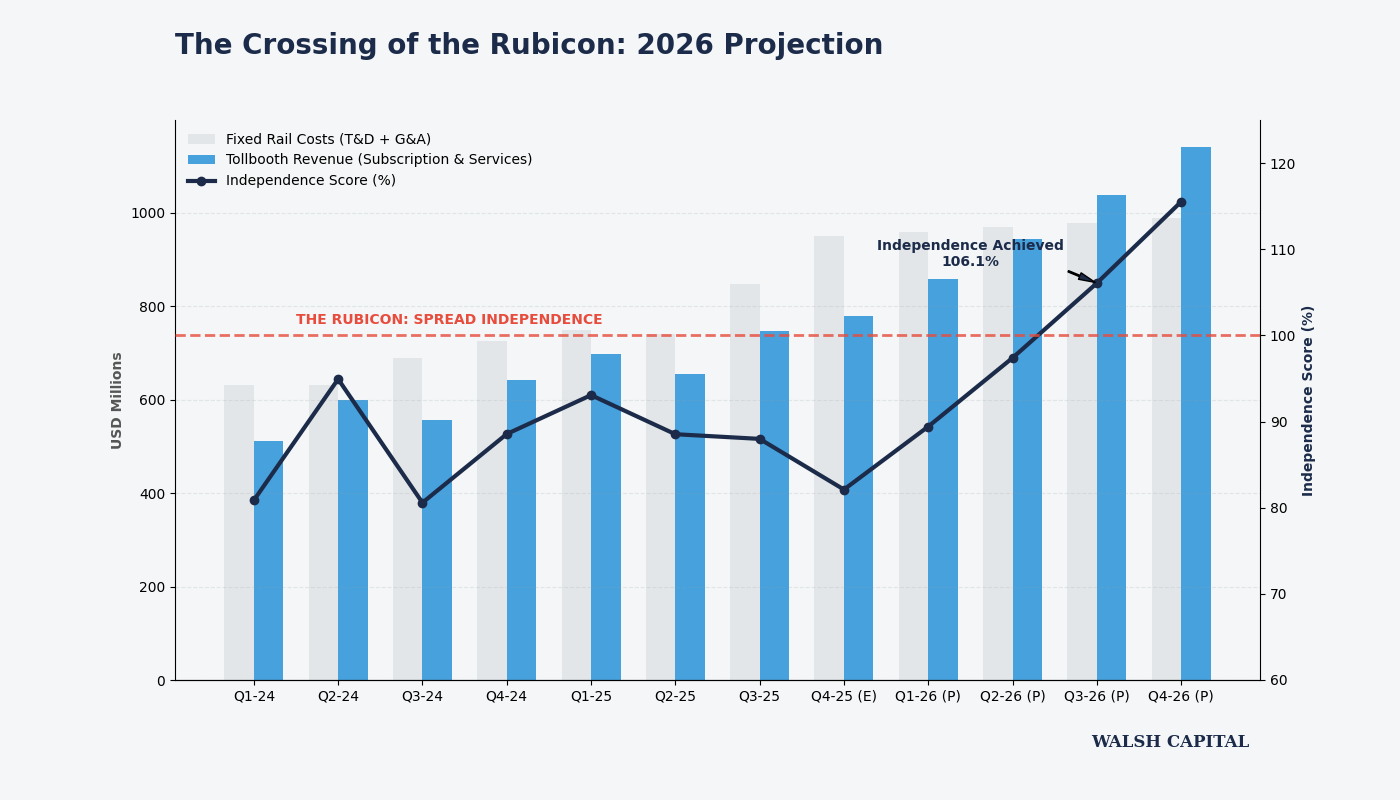

The market continues to price Coinbase as a cyclical exchange, leading to dramatic mispricings during periods of low volatility.

The terminal thesis hinges on a single question: Can the growth in tollbooth revenue outpace the inevitable decay of transaction spreads?

By Q3 2026, persistent revenue could fully subsidize the network's fixed costs.

If Coinbase successfully commoditizes its exchange to subsidize its role as the primary custodian and settlement layer, it becomes a utility. Most investors will continue to wait for a "trading spike" that may never return to 2021 levels, missing the fact that the company’s value is now accruing in the silence of the vault, not the noise of the ticker.