Why Frequency Matters More Than AUM For Robinhood

If you ask people what makes Robinhood work, they’ll point to commission-free trading, a clean UI, or retail participation cycles.

All true.

But the feature quietly reshaping the business, almost nobody talks about it, is frequency.

Not assets under management.

Not balances.

Not even users.

Frequency.

How often people make decisions.

How often they act.

How often they engage with risk.

That’s what Robinhood is optimizing for again.

The Old Robinhood Was an Asset Business

The New One Is a Behavior Business

For years, Robinhood traded like a retail broker. Revenue rose when markets were hot, fell when activity cooled, and lived or died by episodic participation. AUM mattered. Net new accounts mattered. Everything was cyclical.

That model capped upside.

What’s changed is not branding or product sprawl. It’s the revenue mix, and the behavior underneath it.

Over the last two years, Robinhood’s growth has come from products people touch repeatedly, not portfolios they check occasionally.

Options.

Crypto.

Event-driven trades.

These are not balance-sheet products. They’re decision products.

And the income statement is starting to reflect that shift.

The P&L Tells the Story Before the Narrative Does

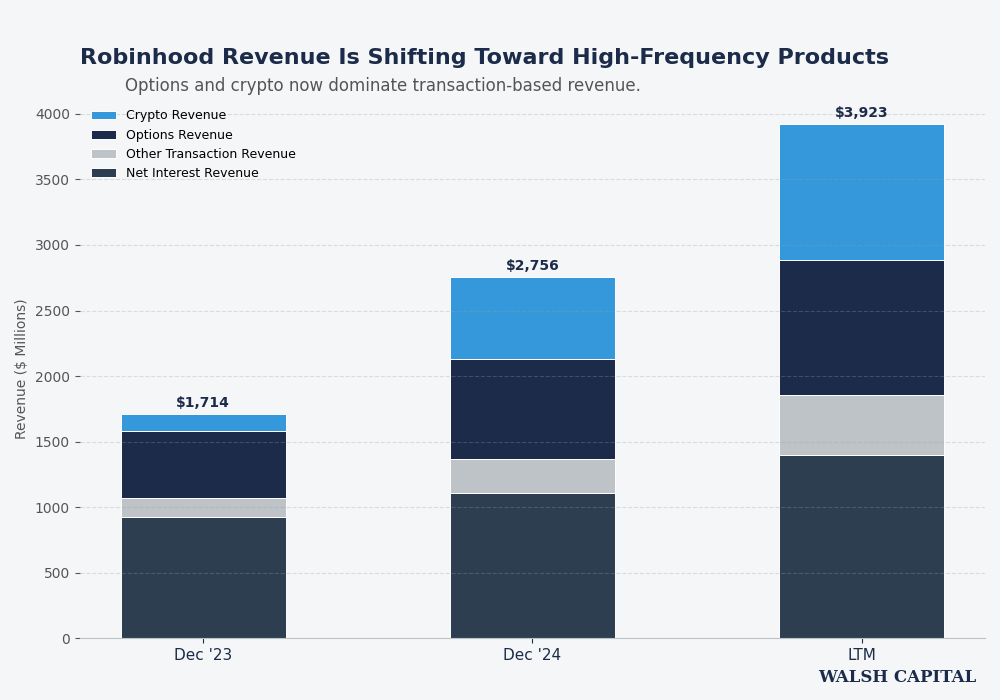

Transaction-based revenue has re-accelerated sharply, but not because retail suddenly loves equities again.

It’s because frequency-driven products are dominating.

Options revenue and crypto revenue now account for the majority of transaction-based income. Together, they exceed two billion dollars on a trailing basis, roughly matching the entire transaction engine.

This matters for one reason:

frequency scales faster than balances.

A user doesn’t need more money to trade options more often.

They don’t need higher AUM to engage with crypto volatility.

They just need reasons to act.

That’s a very different growth function.

Net Interest Is the Flywheel, Not the Engine

At the same time, net interest revenue has quietly become a second pillar.

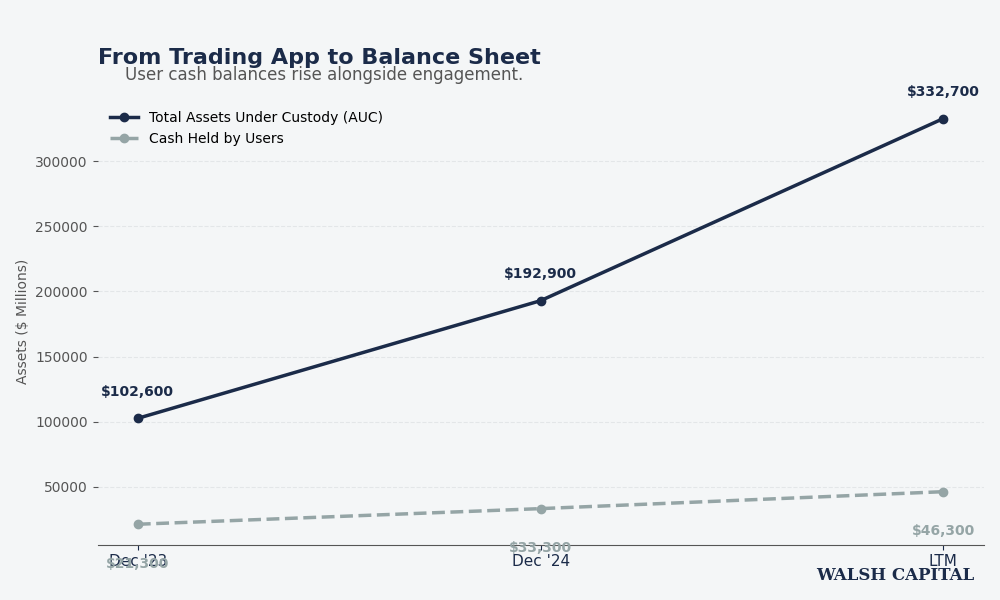

Cash balances held by users continue to rise. Total assets under custody have more than tripled in two years. Net deposits are accelerating.

This isn’t speculative capital. It’s behavioral trust.

People don’t leave tens of billions of dollars sitting in an app they don’t rely on. Cash balances are a lagging indicator of habit.

And habits are what stabilize earnings when trading cools.

This is how a trading platform starts to look like a consumer balance sheet, not just a brokerage.

When Frequency Meets Software Economics

Here’s the inflection point the market is slowly pricing in:

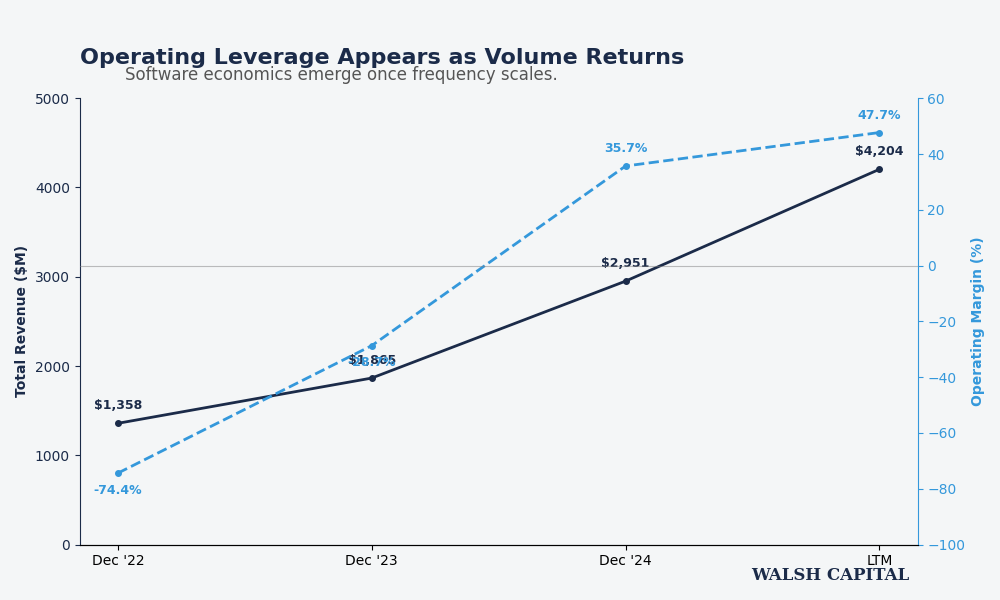

Robinhood’s gross margins now resemble an exchange, not a broker.

Operating margins are approaching 50%.

Incremental revenue is falling through at scale.

That only happens when volume compounds on top of a largely fixed platform. This is operating leverage driven by behavior, not headcount. Once that dynamic appears, valuation frameworks change.

Slowly at first. Then suddenly.

Why This Matters Beyond Robinhood

This isn’t really a Robinhood story.

It’s a story about how retail finance is reorganizing around events instead of assets.

Markets already reveal this:

Options volume spikes on CPI days.

Crypto volatility clusters around macro headlines.

Participation rises when outcomes are discrete and time-bound.

Prediction markets, event contracts, and AI-assisted decision tools don’t create this behavior. They expose it.

Platforms that win won’t be the ones holding the most money.

They’ll be the ones shaping how often people decide.

The Risk Is Obvious. The Direction Is Not Accidental.

Higher frequency always carries trade-offs:

Regulatory scrutiny increases.

Losses become more visible.

Behavior becomes harder to defend rhetorically.

But structurally, this is where retail finance is moving.

From portfolios to probabilities.

From balances to behavior.

From AUM to action.

Robinhood is building for that world again.

Not loudly.

Not recklessly.

But deliberately.