Fragmented Markets, Preemption, and Venture Capital in the Gaming Industry

The gaming industry is characterized by fragmentation, innovation, and intense competition. We'll explore the challenges of coping with fragmentation in the gaming industry, the concept of preemption, and how venture capital firms approach investing in gaming startups. We'll also provide practical tips for navigating fragmented markets from a venture capitalist's perspective.

Coping with Fragmentation in the Gaming Industry

Fragmented markets like the gaming industry are marked by numerous competitors, rapid innovation, and shifting consumer preferences. Gaming companies must navigate the industry's complexities to thrive in this environment by positioning themselves strategically and capitalizing on growth opportunities.

Preempting in the gaming industry can take various forms, such as securing exclusive partnerships, developing cutting-edge technology, or locking in key distribution channels. To be successful, a preemptive firm must establish credibility by demonstrating its commitment and ability to execute its strategy.

Epic Games and the Preemptive Power of Exclusive Deals

Epic Games, the developer behind Fortnite, launched the Epic Games Store as a digital distribution platform to compete with established players like Steam. Epic secured exclusive game distribution deals with multiple developers to differentiate itself, offering them a more favorable revenue share. Epic Games carved out a niche in the crowded gaming market by preempting competition with these exclusive deals.

Mitch Lasky, a partner at Benchmark Capital and an early investor in Riot Games, has commented on the importance of strategic positioning in fragmented markets, stating, "In a crowded market, finding the right niche and delivering a product that stands out is crucial for success."

Venture Capital Decision Points in the Gaming Industry

Venture capital firms evaluate potential investments in gaming startups by considering several decision points, including market assessment, differentiation, vertical integration, reputation and track record, communication, traction and financials, and due diligence. Below is a summary of the benefits and risks associated with each decision point:

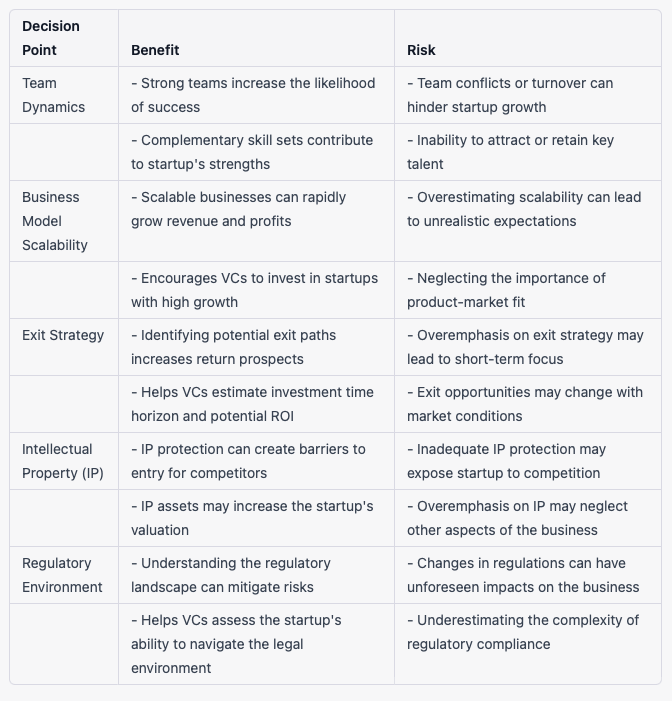

In addition to these decision points, venture capitalists may consider other factors, such as team dynamics, business model scalability, exit strategy, intellectual property, and the regulatory environment:

Gaming Industry Examples and Venture Capital Success Stories

Venture capital firms like Sequoia Capital and Benchmark Capital have backed successful gaming startups by applying their investment decision processes. Some notable examples include:

Supercell: A mobile gaming company known for its hit games like Clash of Clans and Clash Royale. Supercell's differentiated approach to game development, strong team dynamics, and scalable business model attracted significant venture capital investment. The company's commitment to focusing on a few high-quality games and its unique organizational structure, with independent "cells" working on separate projects, made it an attractive investment. Ilkka Paananen, CEO of Supercell, has discussed the importance of team dynamics and the company's unique structure, saying, "Our cell structure allows us to be agile and innovative while minimizing bureaucracy."

Unity Technologies: The developer of the Unity game engine, which powers a substantial portion of the world's mobile and desktop games. Unity's strong reputation, unique technology, and ability to communicate its vision attracted venture capital support. By offering a robust and versatile platform for game developers, Unity differentiated itself from competitors and captured a large share of the gaming engine market.

Riot Games: The developer behind the viral game League of Legends is an example of a successful venture-backed gaming company. Riot Games secured funding from Benchmark Capital and FirstMark Capital, among others. The company's differentiated approach to game design, strong community engagement, and continuous updates to its game made it an attractive investment opportunity. League of Legends has since become one of the industry's most popular and enduring games, with a thriving eSports scene and a dedicated player base. David Higley, Managing Director at FirstMark Capital, has spoken about the firm's decision to invest in Riot Games, noting, "Riot's deep understanding of their players, commitment to innovation, and ability to create a strong community around their game were key factors in our decision to invest."

Gaming Investments that Failed and Lessons Learned

Despite the successes in the gaming industry, some investments have not panned out as expected. Understanding the reasons for these failures can provide valuable insights for future investments:

Ouya: A crowdfunded Android-based gaming console that aimed to disrupt the market by offering a low-cost alternative to traditional consoles. Ouya raised millions of dollars in funding but failed due to poor execution, a limited game library, and intense competition from established console manufacturers. Key lessons include the importance of execution, understanding competitive dynamics, and ensuring a solid product-market fit. Ben Horowitz, a co-founder of venture capital firm Andreessen Horowitz, has reflected on the challenges faced by Ouya, stating, "Ouya's failure highlights the importance of understanding the competitive landscape and ensuring that a startup's product or service truly resonates with consumers."

Gazillion Entertainment: The developer behind the Marvel Heroes online game sought to capitalize on the popularity of Marvel characters. Despite securing significant funding, Gazillion faced challenges such as management turnover, development delays, and ultimately losing its Marvel license rights. The company's failure underscores the importance of stable management, timely execution, and the risks of relying on third-party intellectual property.

Navigating Fragmented Markets from a Venture Capitalist's Perspective

To effectively navigate fragmented markets like the gaming industry, venture capitalists can consider the following strategies:

Focus on niche opportunities: Identifying and investing in startups targeting underserved niches within the gaming industry can lead to outsized returns. These niches may have less competition and untapped potential.

Prioritize adaptability: Invest in companies with a demonstrated ability to adapt to changing market conditions, as fragmented markets are often characterized by rapid technological advancements and shifting consumer preferences.

Leverage industry expertise: Engage industry experts and advisors to help assess the competitive landscape, identify key trends, and evaluate potential investments.

Maintain a long-term perspective: Recognize that successful investments in fragmented markets may take time to mature, and be prepared to support portfolio companies through various stages of growth.

Diversify your portfolio: Spread investments across various sub-segments of the gaming industry to mitigate the risks associated with market fragmentation and reduce exposure to any single trend or competitor.

The gaming industry is a fascinating and challenging landscape for investors, with its fragmented markets and constant innovation. By understanding the strategic challenges and applying a rigorous venture capital decision-making process, investors can uncover exciting opportunities and contribute to the growth of the gaming industry. Learning from both successes and failures in the gaming space, venture capitalists can refine their investment strategies and navigate the complex dynamics of this rapidly evolving market.